2025 Outlook: Balancing Economic Growth and Policy Changes

The year 2024 will be remembered for exceptional market performance driven by improving macroeconomic conditions. Inflation fell to more palatable levels, allowing central banks to cut policy rates, further stimulating economic activity and leading to strong GDP growth. Corporate profit growth rates also accelerated throughout the year, albeit unevenly across sectors.

Heading into 2025, there are many reasons to remain optimistic. Moderating inflation, more interest rate cuts, and the potential for a less stringent regulatory environment under the Trump administration are all tailwinds that could bode well for markets. However, rising geopolitical tensions, elevated equity valuations, looming uncertainty around the implementation and potential impact of tariffs, and a rapidly increasing government debt burden are all reasons to warrant caution.

Potential Policy Implications

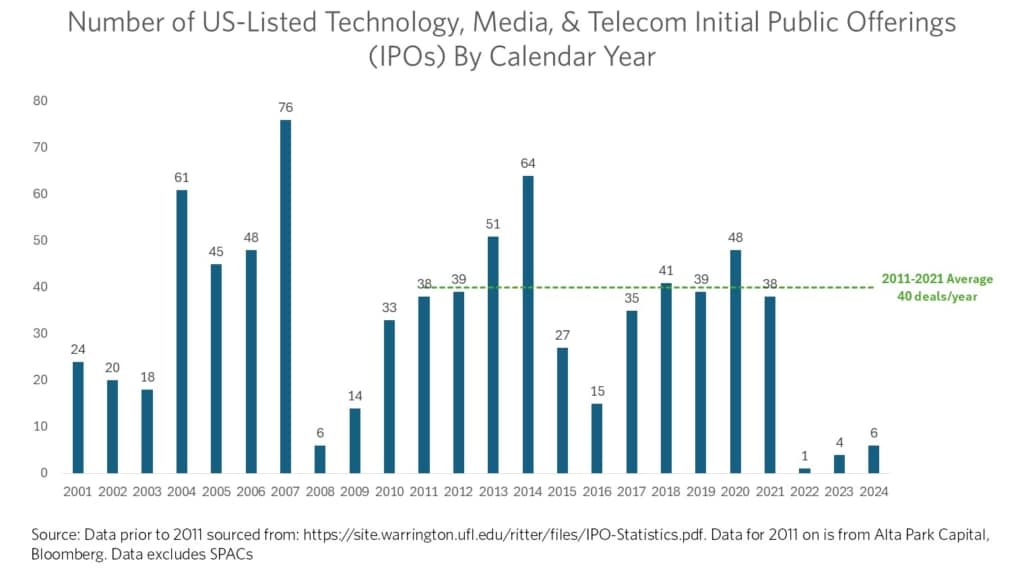

President-elect Trump’s decisive election victory has clearly ushered in a newfound excitement about the possibility of a pickup in investment, dealmaking, and, perhaps, government spending reform. Stocks have rallied, policy rates have declined, and the dollar has strengthened since election night. Nearly all newly elected presidents enjoy a honeymoon period in which the public is hopeful about the potential of better times ahead before the hard work of governing begins. The market is currently assigning a high probability of lower corporate tax rates and a looser regulatory environment under the Trump administration, leading to the potential for higher economic and corporate earnings growth and an uptick in M&A and IPO activity, particularly within the technology sector, where corporate activity has been muted in recent years.

The most significant wild cards relating to policy uncertainty in 2025 are the potential implementation of tariffs and government spending reform. President-elect Trump has made a series of appointments to his incoming administration, highlighted by his selection of Scott Bessent as Treasury Secretary and the newly formed Department of Government Efficiency (DOGE), led by Elon Musk and Vivek Ramaswamy. The Treasury Secretary’s role is crucial in managing the schedule of tariffs to ensure the president’s objectives are being met without triggering unintended economic consequences.

Major policy changes are often announced quickly but take time to implement. Although the current favorable macroeconomic conditions detailed above are expected to continue into 2025 without disruption, the sequence of new policies and the rigor of their implementation will likely impact market returns in the year ahead, further highlighting the importance of Bessent’s role as Treasury Secretary within the Trump Administration. If tax cuts are prioritized first, Wall Street analysts will likely increase their 2025 and 2026 corporate earnings estimates, which could provide a nice tailwind for stocks. Conversely, if tariffs are the focus day one of the new administration, concerns about reigniting inflation and corporate profit margins may arise.

The greatest threat to America’s long-term prosperity is the unbridled desire to spend beyond its means and fund long-term liabilities with short-term debt. While it’s easy for economists and market pundits alike to pontificate on the implications of America’s spending problem, intellectual honesty and the willingness to admit “known unknowns” are critically important when assessing fiscal policy issues.

Despite America spending beyond its means since WWII, the U.S. dollar remains the world’s reserve currency. Treasury bonds are the most liquid and in-demand sovereign debt and America remains home to most of the world’s largest and most innovative companies. The truth is, nobody knows how much is too much when it comes to our national debt. The ambitions of the newly formed DOGE present an opportunity to streamline government operations and reduce wasteful spending, potentially leading to substantial savings and a more sustainable fiscal policy.

AI: The Future Depends on Future Adoption

U.S. equity valuations remain elevated compared to historical norms as the consensus is growing that AI is driving the next technology revolution. The current concentration within the S&P 500 highlights just how important a small number of companies linked to AI have become. These companies, known as the Magnificent 7, now make up 32% of the index and have driven more than 70% of the S&P 500’s return since the beginning of 2023. This outperformance has led to higher valuations for the Magnificent 7, which in turn has elevated valuations for the entire index, given their current 32% weighting.

The most important question for U.S. equity investors is whether the expectations embedded in the market today project a realistic path to future earnings. The answer depends on various factors. Some, like lower corporate taxes or tariffs, can be forecasted with varying degrees of reliability. Others, like geopolitical events, are impossible to foresee.

One of the primary factors in determining whether equity valuations are too expensive in today’s market is the future adoption of AI, which is entirely dependent upon the use cases of AI becoming more apparent and persuasive. The Magnificent 7 have invested billions in AI based on the belief that both corporations and consumers will use their AI products, such as Microsoft Copilot, Meta AI, Apple Intelligence, and Google Gemini.

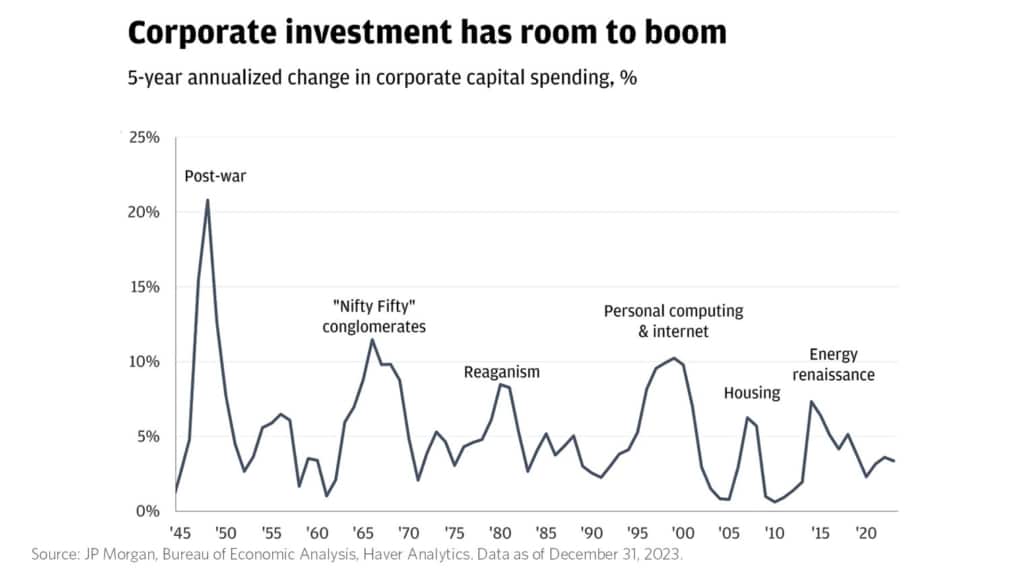

It is impossible to predict the future use cases of AI today, just as it was impossible to predict social media as a future use case of the internet in 1995. However, it does seem increasingly likely that AI adoption and its related spending will continue to increase over the coming years. Although the Magnificent 7 have already made significant investments to build their own AI products, the chart below shows that total corporate capex was relatively muted over the last five years, potentially suggesting corporations have room to spend on new technology as AI adoption increases.

As we approach 2025, portfolio positioning and diversification become increasingly important. Domestic equity valuations remain elevated, while international equities face potential headwinds from tariffs and geopolitical uncertainties. Credit spreads are tight, and private markets are flush with capital waiting to be deployed. The same macroeconomic tailwinds that propelled risk assets higher in 2024 are expected to continue driving momentum into 2025.

We enter the new year with enthusiasm and optimism and yet remain committed to a selective and cautious approach within our investment strategies.

General Performance Information: The performance results included in this article are actual returns which have been compiled by Tolleson Wealth Management (“TWM”). Individual investor returns may or may not be similar to the returns shown. The returns shown are based on index information and are strictly for illustrative purposes only. An investor cannot invest directly in the index shown. Investors should refer to their account statements for their actual return. Returns of this type may not show what impact material economic and market factors may have had on TWM’s decision-making at that time. Past performance is no guarantee of future results. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. All investments involve risk, including the loss of principal. These returns do not account for manager or other advisory fees that will impact an investor’s overall return. An investor’s return will be reduced by advisory and other expenses. TWM’s advisory fees are described in Part 2a of our Form ADV. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Opinions expressed are current opinions as of the original publication date appearing in this material only. Any opinions expressed are subject to change without notice and TWM is under no obligation to update the information contained herein. TWM disclaims responsibility for the accuracy or completeness of this report although reasonable care has been taken to assure the accuracy of the data contained herein. This material has been prepared and is distributed solely for informational purposes only and is not a solicitation or an offer to buy a security or instrument or to participate in any trading strategy. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction.

Index Disclosure: The returns and volatility of the indices displayed may be materially different than the investor’s account, and an investor’s holdings may differ significantly from the securities that comprise the indices. The indices are disclosed to allow for comparisons to well-known and widely recognized indices and may or may not be appropriate for performance comparisons. An investor cannot invest directly in the index.